Who Pays for Healthcare in Switzerland?

The Swiss healthcare system is one of the best in the world. Everyone living in Switzerland can benefit from it, no matter if they’re a citizen, permanent resident, or temporary migrant. So, how is healthcare in Switzerland funded, and how much will you pay?

The Swiss Healthcare System

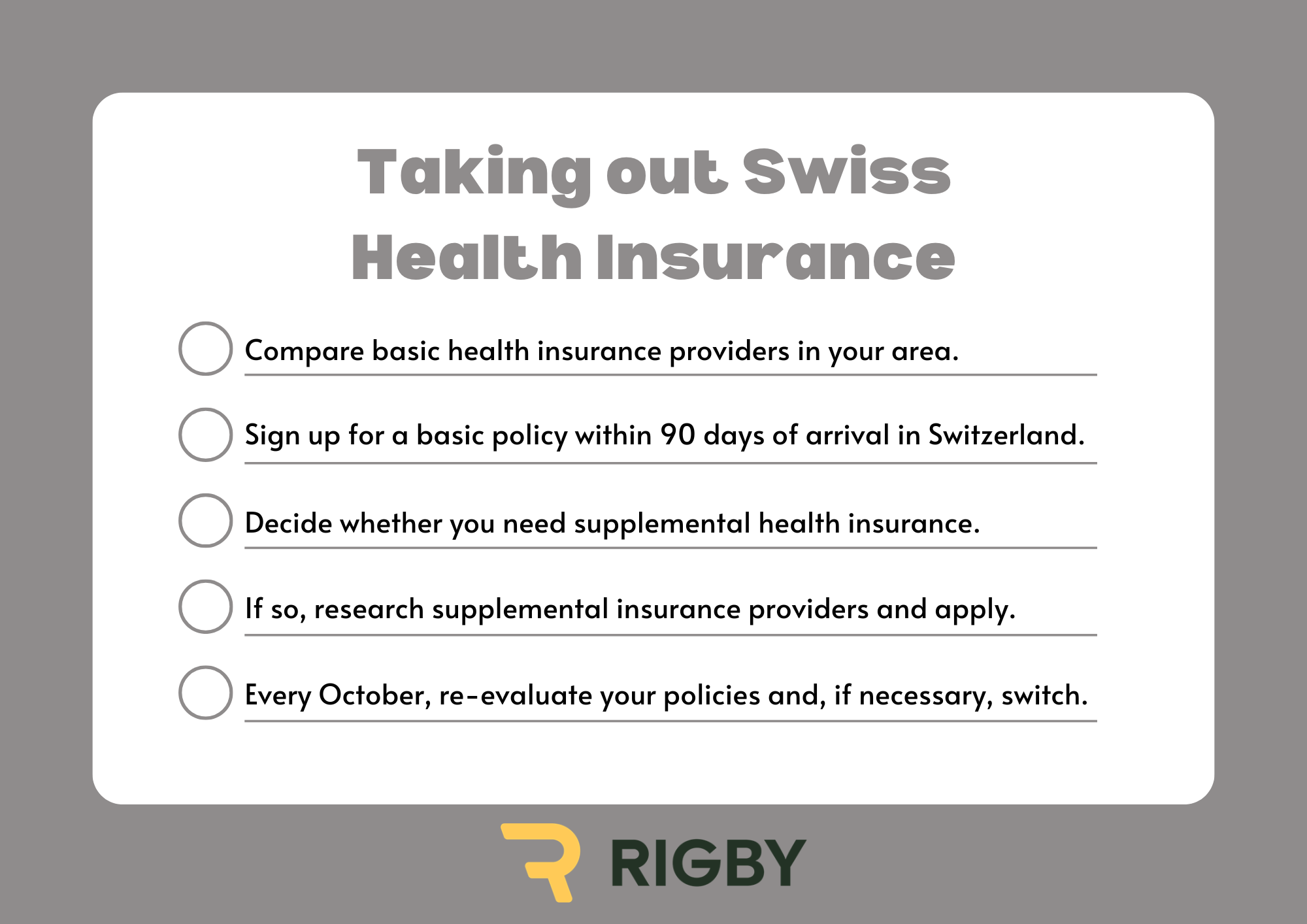

If you live in Switzerland, you have access to a world-class network of hospitals, doctors, and clinics. But although the system is universal, it’s not paid for by taxes or your employer. Instead, you have to take out basic health insurance within 90 days of moving to Switzerland. If you become seriously ill, this insurance pays for the majority of your healthcare costs.

Who Pays for What?

The state, the health insurance providers, and the individual share the costs. In 2022, Switzerland spent CHF 92.9 billion on healthcare, which corresponds to around CHF 882 per person per month. The average inhabitant pays less than half of this in health insurance premiums per month, but they may pay some out-of-pocket expenses if they require medical attention. Any remaining shortfall is covered by the state.

Basic Health Insurance

Everyone in Switzerland has to take out basic health insurance. There are around 50-60 different authorised providers, so there is a lot of competition for customers.

If you’re taking out insurance for the first time, it’s best to compare providers on sites like Moneyland or Comparis. Each provider offers the same coverage, but the prices can vary significantly. Once you’ve signed up, you can only switch once a year, in November. Your provider should send you a letter stating next year’s fees in October. If you want to minimise your costs, compare their offer with other available ones. You can often save hundreds of francs a year by switching providers.

How Much Do the Premiums Cost?

Some parts of the Swiss healthcare system are governed by the state, but much of it is organised individually by the cantons. Therefore, the costs of healthcare in Switzerland may depend on where you live.

In 2024, the average cost of basic health insurance premiums was around CHF 360 per month. However, what you will pay depends on:

- Your age: Younger customers typically pay less. Premiums are lowest for children.

- Your insurance company: Some insurers offer better deals to certain types of customers than others. It’s best to compare providers.

- Your chosen deductible: The minimum deductible is CHF 300 per year, but you can increase it to up to CHF 2,500 per year. This can reduce your premiums by over CHF 1,500 per year.

- The type of plan you choose: Aside from standard health insurance, there are several more affordable options.

Reducing the Costs

There are three types of special healthcare plans that can reduce the cost of your premiums:

- Health Maintenance Organisation (HMO) plan: Your choice of medical professionals is restricted to a limited network of healthcare providers.

- Family doctor model: You have to visit your family doctor before you can access more specialised care.

- Telemedicine model: You have to book a virtual appointment before you can see a doctor in person.

All three models are based on the gatekeeping principle. You’ll only gain access to a doctor if your condition is deemed severe enough to require medical intervention.

Is Support Available?

People with low incomes can get a premium reduction. This is partly paid for by the state and partly by the cantons. To request a premium reduction, you have to contact the relevant cantonal office, which can be found on the Swiss government website.

What Is the Excess or Co-Payment?

In addition to your premiums, you will also pay an excess, sometimes called co-payment. This is either 10% of the cost of your treatment or CHF 700, whichever is lower. Therefore, the maximum you will pay for treatments out-of-pocket per year is your chosen deductible plus CHF 700.

If you need to go to hospital, you will also have to pay CHF 15 per day for necessities like food and electricity. However, any medical care provided at the hospital is covered by your health insurance.

What Is Covered?

Basic health insurance is comprehensive, and it covers most medical needs:

- Almost all treatments carried out by doctors.

- Treatments or services prescribed by a doctor but carried out by someone else. This might include occupational therapy, treatments administered at the patient’s home, and physiotherapy.

- Examinations and medical tests.

- Some types of complementary medicine like acupuncture and classical homeopathy.

- Hospital treatments.

- Around 3,000 medicines.

- Preventive measures like vaccinations and screening examinations.

- Examinations and treatments related to maternity.

- Medical transport and rescue: Basic health insurance covers 50% of the cost of ambulance transport, up to a maximum of CHF 500. It also covers 50% of the cost of rescue, for example after a mountaineering accident, up to a maximum of CHF 5,000.

For a more comprehensive list, download the government’s leaflet.

What Do I Have to Pay Out-Of-Pocket?

Aside from your monthly premiums and the co-payment of up to CHF 700, you may have to pay for the following treatments yourself:

- Complementary medicine practiced by a provider who is not listed in the Register of Medical Professions.

- Complementary medicine or treatments that are not prescribed by a doctor.

- Screenings that are not prescribed by a doctor.

- Vaccinations that are not listed in the Health Insurance Benefits Ordinance or authorised by Swissmedic.

- Glasses and contact lenses: Health insurance typically pays CHF 180 per year for children under 18. Adults who don’t suffer from serious visual impairment or certain illnesses have to pay for their own glasses and contact lenses.

- Dental treatment, unless it is related to a serious disorder of the masticatory system or necessary to ensure the success of another type of treatment.

Supplementary Healthcare in Switzerland

If you have a specific medical condition or would like more comprehensive protection, you might benefit from supplementary health insurance. Unlike compulsory insurance, this type of policy isn’t uniform. There are many different bundles to choose from.

It’s also worth noting that you usually have to fill in a questionnaire before you can take out supplementary insurance. Providers have the right to refuse you or charge you higher premiums based on your medical history.

How Much Are the Premiums?

The costs of supplementary Swiss healthcare vary greatly depending on the chosen policy, the provider, your age, and your medical history. Some policies cost well under CHF 100 per month, while others cost several hundreds of francs. Location also makes a difference, as insurance is more expensive in some cantons than in others.

What Is Covered?

Supplementary policies might pay for medicines that aren’t covered by basic insurance, ambulance costs, a more comprehensive list of alternative treatments, additional checkups and screening examinations, dental work, glasses and contact lenses, gym memberships, and even legal expenses for disputes between you and medical service providers. As mentioned, there are different types of bundles, and not everything is covered by every policy.

There are also hospital supplementary policies. They entitle you to a more luxurious and sometimes even private room in hospital. Sometimes, they also include treatment by the senior or chief physician of the relevant department.

The standard of healthcare in Switzerland is very high. Even with basic insurance, you can benefit from access to thousands of medications and hundreds of different types of treatments. Sign up for our Rigby AG newsletter to access our Living in Switzerland ebook. It contains more information about every aspect of living and working in Switzerland.