What Are the Best Banks in Switzerland for Foreigners?

Opening a bank account is an important step when you move to Switzerland. Swiss banks offer foreigners a comprehensive range of account types. But with a choice of over 250 banks, it can be hard to know where to start. So, what are the best banks in Switzerland for foreigners? In this article we’ll take a look into the different possibilities for opening a current or checking account.

The Swiss Banking System

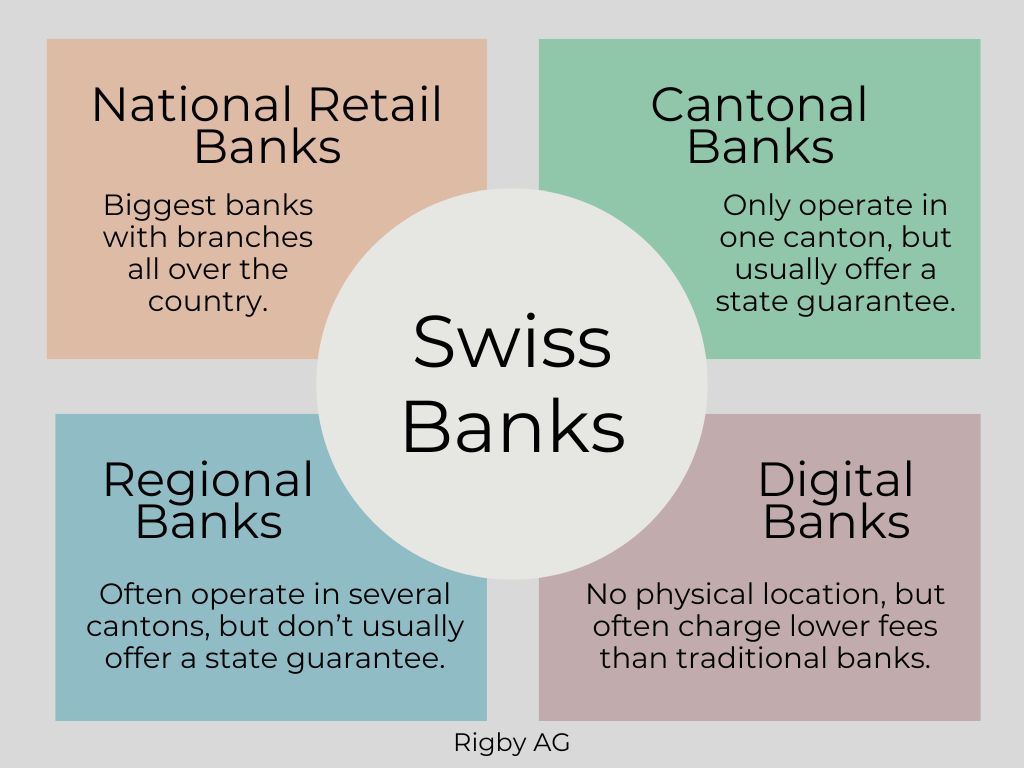

Before opening a current account, spend some time researching the options in your area. The fees charged by banks vary wildly, so you can save a lot of money if you shop around. There are four main types of banks: national, cantonal, regional, and digital.

National Retail Banks

Large national banks have branches in most Swiss cities and towns. UBS is the largest, but some other popular ones are Post Finance, a subsidiary of the Swiss Post, and Migros Bank, which is associated with one of the main Swiss supermarkets.

If you’re not sure you’ll settle in your canton long-term, a national bank may be best because you can keep it when you move to a different area within Switzerland. However, these banks often charge high fees.

Cantonal Banks

Except for Appenzell Ausserrhoden and Solothurn, each canton has a government-owned bank. Sometimes, the interest rates and fees these smaller banks offer are more competitive.

Many cantonal banks also offer a state guarantee — although there are exceptions like Bern, Vaud, and Geneva. This means that any money deposited is fully protected. National retail banks typically have deposit insurance schemes that only cover the first CHF 100,000.

However, cantonal banks are usually only open to locals. If you move to a different canton, you may have to switch.

Regional Banks

Regional banks often cover larger regions than cantonal banks, so they work well for people who need access to a branch in several adjacent cantons. However, they don’t offer the same state guarantee, so only the first CHF 100,000 is protected.

Digital Banks

Some banks like Neon and Revolut don’t have physical branches, so you can only complete transactions online. However, they can be good banks in Switzerland for foreigners because they often charge lower fees than national or regional banks. Some digital banks like Neon are cheap to use abroad, which is not always the case with other Swiss banks.

Further information: Listen to our podcast episode about setting up your Swiss finances with The Poor Swiss

Best Banks in Switzerland for Foreigners

Once you’ve chosen a type of bank, you may still have multiple options. Several factors such as your eligibility, the fees the bank charges, the languages spoken, and the types of products and services offered determine which bank is best for your situation.

Eligibility

If you’re a resident in Switzerland, you should be able to open an account with most banks. However, some may refuse you depending on your residence permit and where you’re from. Due to strict regulations, people from the US sometimes find it harder to open a bank account. They may be stuck with one of the larger banks, at least initially.

Fees

Look carefully at the fees charged by Swiss banks since some can be very expensive. Here are the most common fees you may be charged:

- The base fee: Some accounts are free, but others charge you a small monthly fee, often CHF 5-10.

- Features: Certain features like making payments within Switzerland are normally free, but others like withdrawing money or making payments in foreign currencies are sometimes expensive.

- Additional accounts: You can open savings and investment accounts with most banks, but these can be pricey. Often, it’s better to choose separate banks for different purposes.

Language

In big cities like Zurich, the language may not be an important consideration since almost everyone speaks English. But in smaller towns, choosing a bigger bank might be better for people who don’t yet speak the local language.

Check the websites of the banks you’re considering. If they’ve been translated into English, it’s highly likely that all services will be offered in English. These are often the most accommodating banks in Switzerland for foreigners.

Products and Services Offered

Although you can find lists of the best banks on comparison websites like Moneyland, you have to consider your individual situation. Some questions to ask yourself are:

- What will you be using your account for? If you only need the basics, go for a cheap or free account. If you need advanced features, you may need to pay more.

- Do you need a local branch or are you happy to use a digital bank?

- Do you often travel abroad? If so, you may want to choose a card that doesn’t charge you more to purchase things abroad.

- Do you need to transfer money internationally? Some banks charge more for this than others.

- How much money are you going to keep in your account? If it’s more than CHF 100,000, you may be better off with a cantonal bank.

- Do you want to do online banking? If so, look for a bank with an intuitive mobile app.

How to Open a Bank Account

Once you’ve chosen the best bank for your situation, it’s time to open your account. Start by gathering all the necessary documents. They might include your proof of ID, proof of address, proof of your residence status, and a letter from your employer. You may also have to disclose the source of your initial deposit and give details of your income.

Depending on your situation and country of origin, you may need to have your documents translated and authenticated by a lawyer. You can find out more about this by reading through the info provided on your chosen bank’s website or contacting them directly.

Selecting cost-effective banks in Switzerland for foreigners can save you hundreds or even thousands of francs every year. Sign up for our Rigby AG newsletter to get more insights about moving to Switzerland. You’ll receive our comprehensive Living in Switzerland ebook and monthly updates.

Disclaimer: This guide is for information purposes only and does not constitute financial advice. We strongly recommend seeking professional assistance for specific inquiries or concerns regarding financial matters related to living in Switzerland. The responsibility for any actions taken based on the information in this article lies solely with the reader.