Taxes in Switzerland

Switzerland is considered tax-friendly compared to its neighbouring countries. But understanding how taxes in Switzerland work can be challenging because they vary by area, income, and marital status.

Switzerland’s Geography and the Tax Structure

In many countries, you pay a similar amount of tax no matter where you live. This isn’t the case in Switzerland. Swiss taxes are different in every canton and even municipality. Since the differences can be significant, many businesses and people with high incomes move to low-tax areas like the city of Zug.

Federal Taxes

Direct federal taxes are the same in all areas of Switzerland. They are progressive, so that you pay more the more you earn. As a single person, you don’t pay any tax unless you earn over CHF 15,000 per year. Then, you pay just 0.77% until you reach CHF 32,800 and just 0.88% until you reach CHF 42,900. The highest marginal tax rate is 13.2% for an income between CHF 182,600 and CHF 783,200. Anything above that is taxed at 11.5%. A person earning an average or slightly above average salary might pay between CHF 900 and CHF 1,500 per year.

For married people, the tax-free amount is CHF 29,300. The highest tax rate is 13%, for an income between CHF 150,300 and 928,600. A single-income couple might pay slightly less than a single person earning the same, but a married couple earning two average or slightly above average salaries is likely to pay between CHF 6,000 and CHF 12,000.

Cantonal Taxes

Each canton has its own tax rules and brackets. What you pay will vary significantly depending on where you live. Currently, the cantons with the highest tax rates are Geneva, Vaud, Basel, and Bern. Low-tax cantons include Schwyz, Zug, and Appenzell Innerrhoden.

Municipal Taxes

On top of the federal and cantonal income taxes, you’ll pay municipal or communal taxes. They also vary greatly by area. You might live in a high-tax canton but still pay less than some of your neighbours if you live in a low-tax municipality.

Types of Taxes

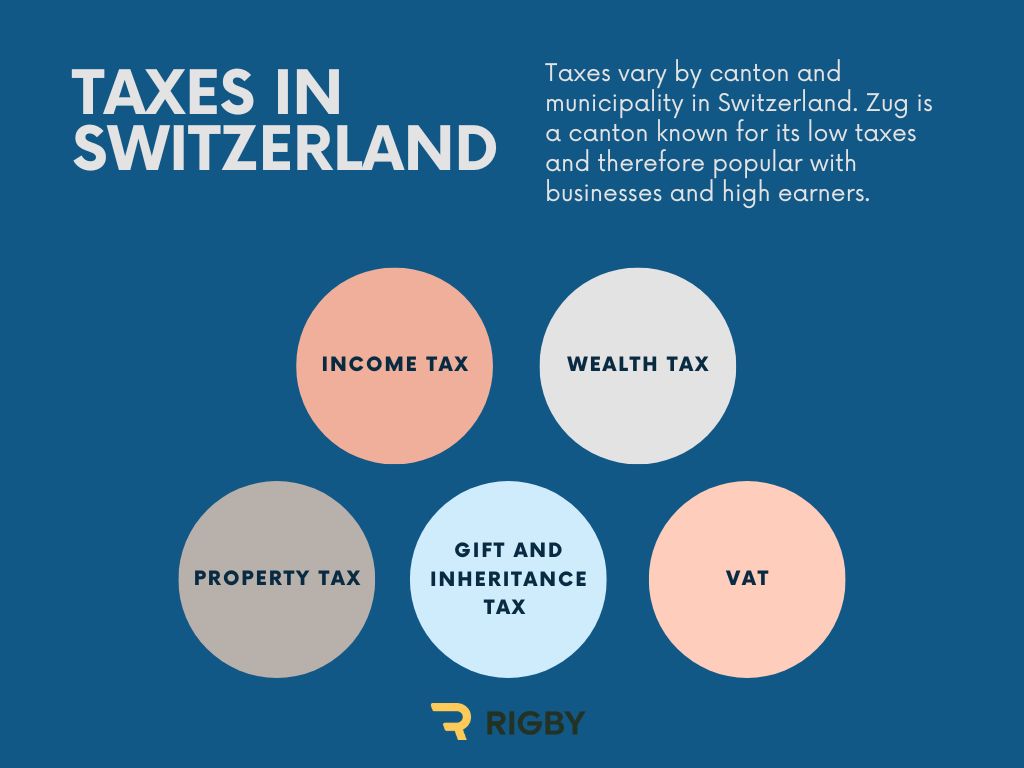

Your most significant tax is likely to be income tax. However, you might also come across several other types of taxes while living in Switzerland.

Wealth Tax

Swiss wealth tax isn’t uniform across the country because it’s determined by the cantons and municipalities. It is levied on your taxable net worth. This is your net worth, including any depreciating assets like vehicles, minus:

- A deduction, usually between CHF 35,000 and 90,000

- Your second pillar pension assets

- Your pillar 3a pension assets

- Any deductible debts.

Capital Gains Tax

There aren’t usually any capital gains taxes for investment gains in Switzerland, unless you’re classed as a professional investor. This might be the case if you trade frequently, derive most of your income from stock market gains, or invest using leverage.

There is a property gains tax for selling real estate. The amount depends on where you live and how long you’ve held the house or apartment. Typically, property gains taxes are high if you’ve owned the property for less than five years. However, there are significant cantonal variations.

VAT

VAT is charged on the consumption of goods and services. It is already included in the prices you see in shops, so there shouldn’t be any surprises. The standard VAT rate is currently 8.1%. The special rate for accommodation is 3.8%, and you’ll pay the reduced rate of 2.6% on food, medicines, and newspapers and books.

Property Taxes

There are various types of property taxes in Switzerland:

- Property transfer tax: When you buy a home, you might be charged around 1-3%.

- Imputed rental value: This is a tax for homeowners who live in their own homes. It is charged on about 60-70% of the rent a tenant would pay. However, you can deduct your mortgage interest and any maintenance costs.

- Property tax: There is a separate property tax in many cantons. It’s usually around 0.01-0.3% of the estimated value of the property.

Gift Tax

Large gifts are taxed, but spouses and direct descendants are usually exempt. Gifts to charitable organisations can often be deducted from your tax return.

Inheritance Tax

Spouses, registered partners, and direct descendants are exempted from inheritance tax. If the deceased lived abroad or you live abroad and inherit Swiss property, you may be at risk of double taxation. While Switzerland has agreements with many countries, it’s best to check with a professional if you believe you might be in this situation.

How to Pay Your Taxes in Switzerland

The Swiss tax year coincides with the calendar year. The cantons collect federal, cantonal, and municipal taxes, and you’ll usually pay in instalments. You’ll receive provisional invoices for cantonal and municipal tax during the current tax year. The payment due dates should be on the invoices.

After January 1st, you can fill out your tax return and submit it. Your actual tax burden will then be calculated, and any tax you’ve already paid will be offset against the amount that’s due.

Will I Be Taxed at Source?

You’ll be taxed at source if you’re not:

- A Swiss citizen

- A resident with a C permit

- Married to a Swiss citizen or a resident with a C permit.

In that case, you may not need to fill out a tax return unless you earn more than CHF 120,000 or have significant taxable income or assets that are not taxed at source.

Should I Fill Out a Voluntary Tax Return?

Some people who are taxed at source opt to fill out a voluntary tax return. That way, they can deduct donations and certain types of expenses from their taxes. However, this isn’t always a good idea. Depending on your income and personal situation, you might actually end up paying more.

If your tax burden is significant and you’re not sure whether you should fill out a voluntary return, it’s best to speak to a tax expert located in your canton.

Further information: Optimising Your Finances in Switzerland with Eric from Schwiizerfranke

Taxes in Switzerland are lower than in the neighbouring countries, but they can be challenging to understand. A good staffing company can help you work out how much will be deducted from your salary. Fill out our Rigby AG application form now to find out more about available jobs that suit your profile.