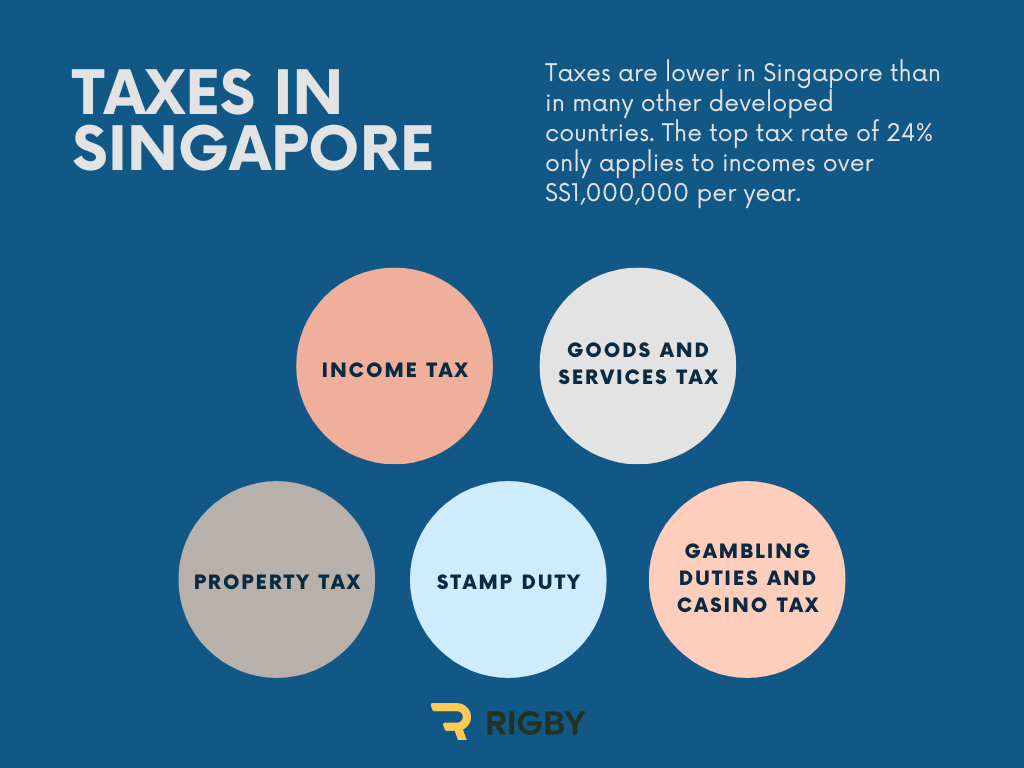

Taxes in Singapore: How Do They Work?

One of the main attractions of Singapore is its low tax rates. Both corporation and income taxes are lower than in many other developed countries. This is one of the reasons why Singapore is a highly sought-after destination for businesses and high earners. Read on to learn more about how Singapore taxes work.

Income Tax

Although Singapore’s tax rates are low, many expats earn a high salary. Therefore, they may pay double digit income taxes. The amount they pay depends on their income and their status.

Tax Rates for Residents and Non-Residents

You are considered a resident if you:

- Are a citizen

- Have Permanent Resident (PR) status

- Don’t have Permanent Resident status but were living in Singapore for more than 183 days in the last year

- Worked in Singapore continuously for a period of 183 days, even if the period is spread over two tax years

- Worked in Singapore continuously for three consecutive years, even if you didn’t spend more than 183 days in the country during the first or last year.

Tax rates for residents are progressive, so you pay more the more you earn. The lowest possible rate is 0%, and the highest is 24%. However, this top rate only kicks in when you earn more than S$1,000,000 per year. You’ll pay less than 20% unless you earn more than S$320,000.

Non-residents pay a flat rate of 15% or the progressive resident tax rate, whichever is higher. Other income, like rental or pension payments, is taxed at 24%.

Are There Any Tax Relief Options?

You may be able to reduce the Singapore taxes you pay in several ways. Some of the options include:

- Course Fees Relief: If you take a course that enhances your skills and employability, you may be able to deduct the fees from your taxes, up to a maximum of S$5,500.

- Central Provident Fund Relief: Citizens and Permanent Residents can deduct contributions to their CPF, the mandatory social security savings plan.

- Parent, Child or Sibling Relief: If you’re caring for a family member, you may get some tax relief to help cover the costs and compensate you for your time.

- Life Insurance Relief: Under certain circumstances, you can deduct life insurance premiums from your taxes.

Goods and Services Tax

This is a tax paid on the consumption of goods and services, both those produced in Singapore and those imported from abroad. GST is also known as VAT. The current rate is 9%.

Property Tax

The owners of properties in Singapore have to pay tax based on the expected rental value of the house or apartment. Owner-occupier tax rates, which apply to people who live in their own homes, are lower than non-owner-occupier rates.

It’s important to note that property tax isn’t the same as the tax levied on rental income. Property tax has to be paid no matter if you’re living in your own home, renting it out, or leaving it empty.

Stamp Duty

Stamp duty is based on either the purchase price or the market value of the property. It starts at 1% and progresses to 6% for residential properties. However, there is also an Additional Buyer’s Stamp Duty. You have to pay this if you’re a:

- Singapore citizen buying a second or subsequent property

- Permanent resident buying any property

- Foreigner, entity, or housing developer buying any property.

ABSD varies greatly depending on your circumstances. For permanent residents, it is 5%, but foreigners without permanent residence status have to pay 60%. The purpose of this tax is to discourage property speculation and make sure the housing market remains sustainable.

Gambling Duties and Casino Tax

General bets, totalisator betting, lotteries, and sweepstakes are taxed. The amount depends on the type of gambling and whether it takes place in a casino or not.

Other Taxes

You may be charged several additional Singapore taxes, depending on your situation. This is especially true if you own a vehicle or a business. Other taxes include:

- Motor vehicle taxes

- Customs and excise duty

- Carbon taxes

- Corporation taxes

Generally, there are no capital gains taxes or gift taxes in Singapore.

Is There an Inheritance Tax in Singapore?

Estate duty, the tax on a deceased person’s assets, was removed on 15th February 2008. Although it was initially seen as a way to redistribute wealth, it didn’t seem very effective as wealth is frequently created by entrepreneurial means in Singapore. Additionally, the removal of estate duty was a way for the city state to attract more high-net-worth individuals.

How and When to Pay Your Singapore Taxes

The tax year in Singapore runs from 1st January to 31st December. You can then start filing your return from 1st March. The return is due on 15th April, or 18th April if you’re submitting it electronically. You should receive your tax bill from the end of April onwards, and you have one month to pay. If you can’t pay your entire bill at once, you can spread out your payments.

There are many ways to pay:

- A GIRO (General Interbank Recurring Order): This is the government’s preferred method. You can either opt for a once-a-year deduction or apply for a payment plan.

- With a PayNow QR code.

- Internet Banking Bill Payment: This is only an option if you have an account with a participating bank.

- Internet Banking Fund Transfer.

- A Telegraphic Transfer: This is convenient if you don’t have a Singapore bank account.

- Via SingPost: Online, at an in-person kiosk or at a post office.

Singapore taxes are relatively low and straightforward. There are generally no inheritance, gift, or capital gains taxes. To find out more about current jobs in Singapore, get in touch with us at Rigby AG. We’ll connect you with suitable opportunities.