Is Switzerland Good for Saving Money?

Switzerland has one of the highest average salaries in the world. This is excellent news for both people who want to live in Switzerland permanently and those who want to eventually return to their home countries. Many expats who come from countries with lower average salaries work in Switzerland for several years and then return home. With the savings from their Swiss jobs, they can support their families, buy a house, or even retire early. Let’s have a closer look at how to save money in Switzerland.

How Expensive Is Life in Switzerland?

Life in Switzerland is known for being expensive. According to Mercer, four Swiss cities are among the ten most expensive places in the world: Zurich, Geneva, Basel, and Bern.

A typical household might spend between 4,000 and 8,000 francs per month. Aside from taxes, the most expensive budget items are usually rent, transport, and insurance.

Further Reading: How Much Do You Need to Comfortably Live in Switzerland?

How Much Money Can I Save?

Despite the high cost of living, the average family in Switzerland saves just under CHF 20,000 per year. That’s three to five times the amount saved in many other countries such as the UK or the US. If you have a job that pays more than the average of just over CHF 81,000, you should be able to save a five-figure amount. Your exact savings rate will depend on your household income, the size of your family, where you live, and your preferred lifestyle.

Money-Saving Tips for Swiss Residents

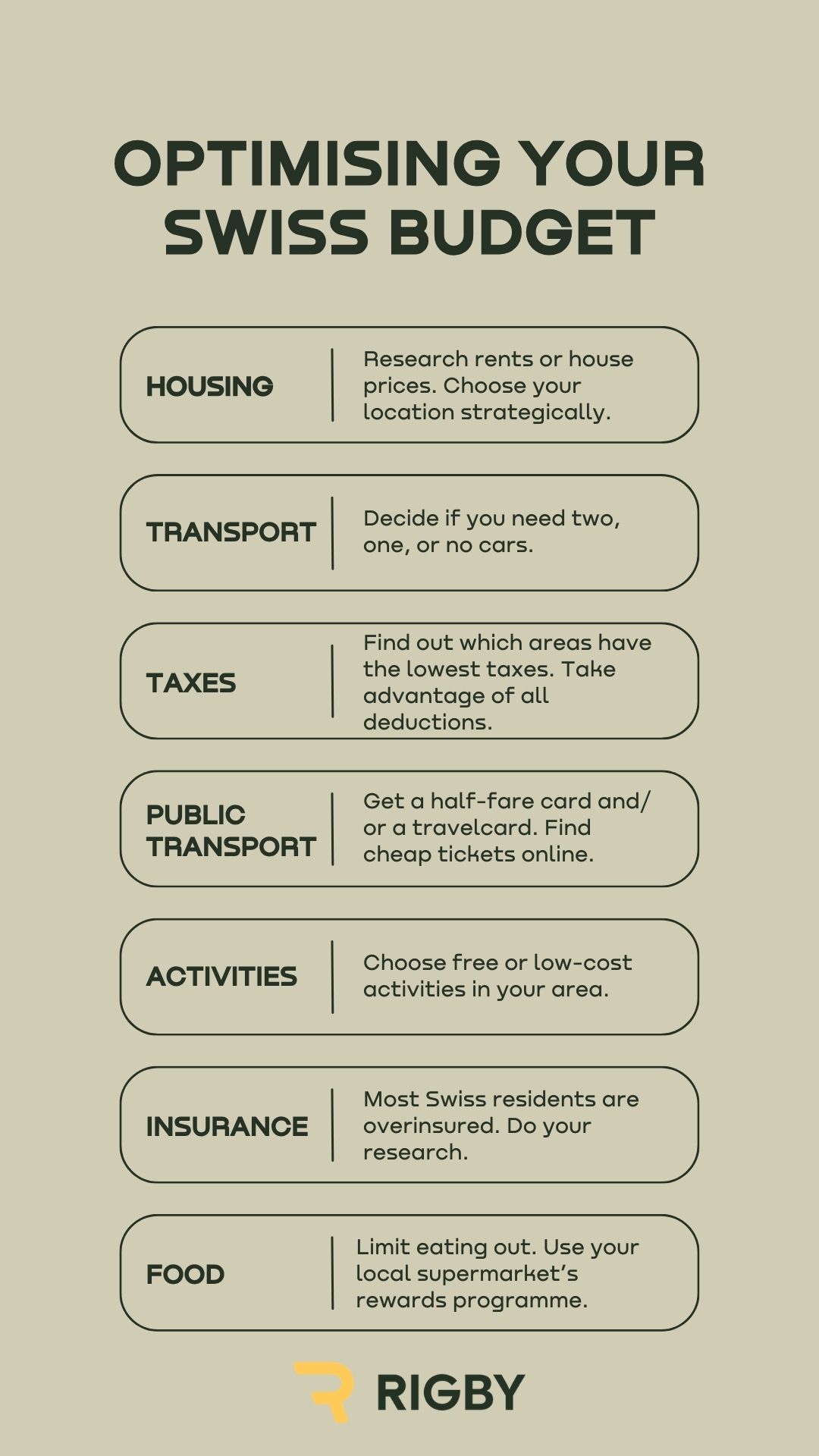

You can reduce the cost of living in Switzerland by making a budget and cutting unnecessary expenses. But you don’t have to stop spending money on the things you love to do. The best way to save money is to optimise the big-ticket items and then move down the line to your smaller expenses.

The Big-Ticket Items

These are the categories most people spend most of their money on. If you optimise them, you’re already 90% of the way there.

- Housing: Rents in certain urban areas can be extremely expensive. Since there are very few ‘bad’ neighbourhoods in Switzerland, consider living in a less prestigious area of town. Most Swiss cities also have surrounding commuter towns, which are easy to reach and much cheaper to live in than the city centres.

- Transport: Owning a car can easily add CHF 1,000 to your monthly budget in Switzerland. Unless you live in a rural area, you likely won’t need multiple vehicles per household. Switching to public transport or even commuting by e-bike could reduce your expenses significantly.

- Taxes: There are significant tax fluctuations in different areas of the country. Some people choose their place of residence based on where taxes are lowest. This, and taking advantage of all deductions, could save high earners thousands of francs a year.

Negotiate and Opt Out

Most bills aren’t negotiable in Switzerland. Since each area only has one electricity and water provider, you can’t call them up and threaten to switch. However, rents are indexed to the reference interest rate, and your landlord has to decrease your rent whenever the reference rate falls. Your rent won’t be adjusted automatically, though. You have to request a reduction. You can use this (German) rent checker to see if you’re eligible for a deduction.

Another thing you can opt out of is church tax. Unless you declare yourself ‘non-denominational’ when you register at your municipality, you’ll likely pay several hundred or even over 1,000 francs a year in church tax. You can opt out by sending your municipality a letter.

Be Smart About Public Transport

For CHF 190 per year, you can buy a half-fare card that covers almost all of Switzerland. On most journeys, you’ll pay 50% of the regular ticket price. If you use public transport frequently, a local or national travelcard is an even more efficient solution. You can also save money by planning ahead, since some tickets are cheaper when you buy them online than at the ticket machine.

Find Free or Low-Cost Activities

You don’t have to spend a lot of money to have fun in Switzerland. Hiking and cycling are two free activities you can do almost everywhere. Many museums, botanic gardens, and parks are free to enter. There is also a Swiss Museum Pass, which costs CHF 177 for one adult and allows you to visit over 500 museums.

Get Insurance, But Not Too Much

In Switzerland, most people spend over CHF 1,000 on insurance. Basic health insurance is mandatory, but many also hold supplemental health insurance, personal liability insurance, building insurance, vehicle liability insurance, and household contents insurance. Think carefully before you buy these policies because you may not need them all. And don’t forget to compare providers on sites like Moneyland.

Reduce the Cost of Your Food Shop

Finally, food can be very expensive in Switzerland. If you go out to a nice restaurant, you can easily spend CHF 50 per person per meal. A great way to save money is to limit eating out to once a week or less. You can also reduce the cost of your weekly food shop by buying supermarket own-brand products and using your shop’s rewards system.

What Should I Do with My Money?

Most Swiss savings accounts don’t offer great interest rates, so you may need to invest your money.* Before you do so, thoroughly research your options. Many banks charge excessive fees, and you could save thousands by choosing a low-cost provider. Here are some things you may want to do with your money.

Retirement Accounts

There are three pillars in Switzerland. The first is the mandatory state pension (AHV). The second is your workplace pension. If you get paid more than CHF 22,680, you have to contribute to this. You can also make additional voluntary contributions if you have any gaps. The third pillar is optional, and you can add up to CHF 7,258 per year. Paying money into retirement accounts comes with tax savings.

Fixed-Term Savings Accounts

You can often get a better interest rate when you lock your money away for a few months or years. Use comparison sites like Moneyland to find the best providers.

Investment Accounts

Investments typically yield the highest return in the long term, but they also come with more risk. If you already know how to invest, you can use a low-cost online broker. If not, you may want to choose a robo-advisor or a bank that offers investment advice.

With a well-paid job, you can save money in Switzerland. Send Rigby AG your application now, and be the first to know about new work opportunities. And for more tips about life in Switzerland, sign up for our newsletter and download our free ebook guide.

*The information provided in this article is for informational purposes only and should not be construed as financial advice.