Is It Expensive to Live in Singapore?

As an expat in Singapore, you can expect a good quality of life, excellent healthcare, great cultural experiences, and a supportive community. However, understanding the cost of life in Singapore for expats is important. Certain budget items like transportation may be quite different to what you’re used to. Let’s have a look at what you might spend every month.

The Cost of Life in Singapore for Foreigners

Although the cost of living can be high in Singapore, most expats can easily afford it thanks to the high salaries and low tax rates. The maximum tax rate is 24%, charged on incomes over S$1,000,000. Money often stretches further in Singapore than in higher-tax countries like Finland or Japan, where residents on a high income may be taxed 50% or more.

Housing

You don’t need to be a permanent resident or citizen to buy property in Singapore, but most expats initially rent an apartment or house, especially if they aren’t sure whether they will stay long-term. Rental prices vary by location, size, and type of property. Some of the options are:

- Rooms: Singles and couples without children sometimes start by renting a room in a shared condo. Although there are options for under S$1,000, many high-quality furnished rooms cost more than that.

- Condos: These are very common, especially in the central neighbourhoods. They often have great facilities and amenities. A one or two-bedroom condo generally costs more than S$2,000.

- Serviced apartments: They offer tailored, hotel-style services, so they’re a good option for those still looking for a permanent place to stay. Serviced apartments tend to be more expensive than equivalent condos.

- Landed properties: Detached or semi-detached houses are expensive in Singapore due to the lack of space. They can easily cost upwards of S$10,000 per month.

There are also HDB (Housing and Development Board) homes, which are built by the government. These properties are more affordable, but there are strict non-citizen quotas. Expats may not be able to apply for them in popular areas.

Utilities

Electricity, water, and gas costs depend on the size of the property and how many people live there. Most households also pay for wifi and phone contracts. Typical utility costs might be S$250-650 per dwelling.

Since all utilities are nationalised, you only need one Singapore Power account. The Public Utility Board is responsible for distributing water, so you can’t change suppliers. However, you can shop around for electricity, gas, and internet. Just keep in mind that there might be a minimum period contract or an exit fee.

Food

If you’re hoping to eat a Western diet, you may have to spend more on food than if you buy local produce from the wet markets. Cold Storage and Marketplace, the supermarkets that stock a wide range of imported foods, are significantly more expensive than NTUOC FairPrice and Giant. The latter both have several tiers, some of which are more upmarket than others.

Eating out can be affordable if you go to hawker centres. There, you can expect to spend less than S$10 on a meal and a non-alcoholic drink. Upscale restaurants and alcoholic beverages are more expensive.

Expect to spend anywhere between S$200 and S$1,000 per person, depending on the diet and the number of meals out.

Transportation

One aspect of life in Singapore for foreigners that is often praised is public transport. Many expats are surprised that they don’t need a car because public transport is so efficient.

There are two public transport systems: the Mass Rapid Transit, MRT, and the Light Rail Transit, LRT. Both are safe, clean, and reliable. The monthly travel pass currently costs $128, but people who live close to their workplace often spend less than that.

Those who want to travel by car but can’t commit to a vehicle of their own use ride-hailing apps like Grab, Gojek, Ryde, TADA, and CDG Zig. They are more expensive than public transport, but typically cheaper than buying and running a car.

Boon Lay MRT station in Jurong West, Singapore.

Boon Lay MRT station in Jurong West, Singapore.

Insurance

Singapore has an excellent social security system, but many parts of this are only available to permanent residents and citizens. New expats may need to get insurance to cover the gap.

Health Insurance

The Singaporean health system is built on three pillars:

- The Medisave programme, which is based on employee contributions.

- The Medishield nationwide catastrophic insurance programme.

- Medifund, a government fund used to pay the medical bills of people in need.

Since expats are only eligible for this system once they become permanent residents, they initially need to pay for healthcare out of pocket or get health insurance. Some costs are covered by employers, but this may not be enough.

A healthy, young person might pay between S$2,000 to S$3,000 per year, but someone older or with pre-existing conditions — or someone who wants an international plan that includes coverage in the USA — will pay more.

Other Insurance Types

Depending on your lifestyle and situation, you may need other types of insurance:

- Life insurance: This is important if you have dependents who rely on your income.

- Critical illness insurance: This can complement health insurance. It kicks in if you’re diagnosed with a serious illness like cancer or a stroke.

- Home or contents insurance: If you own your home or you have a lot of valuable items, you may need to get them insured.

Entertainment and Holidays

There’s a lot to do in Singapore. Many activities and even trips to neighbouring countries can be affordable. However, expats often want to visit their home country at least once every year, which can be expensive if it involves a long trip.

Other Expenses

Keep in mind that there could be additional expenses, such as:

- Debt repayments: If you still have debts like student loans in your home country, they may need to be repaid.

- School fees: Getting into Singaporean public schools can be challenging. Therefore, many expats enroll their children in international or private schools. Unless your employer pays for this, you have to budget S$20,000 to S$40,000 per child per year.

- Payments to dependents: Some people move to Singapore to support their families. They may want to send money home each month.

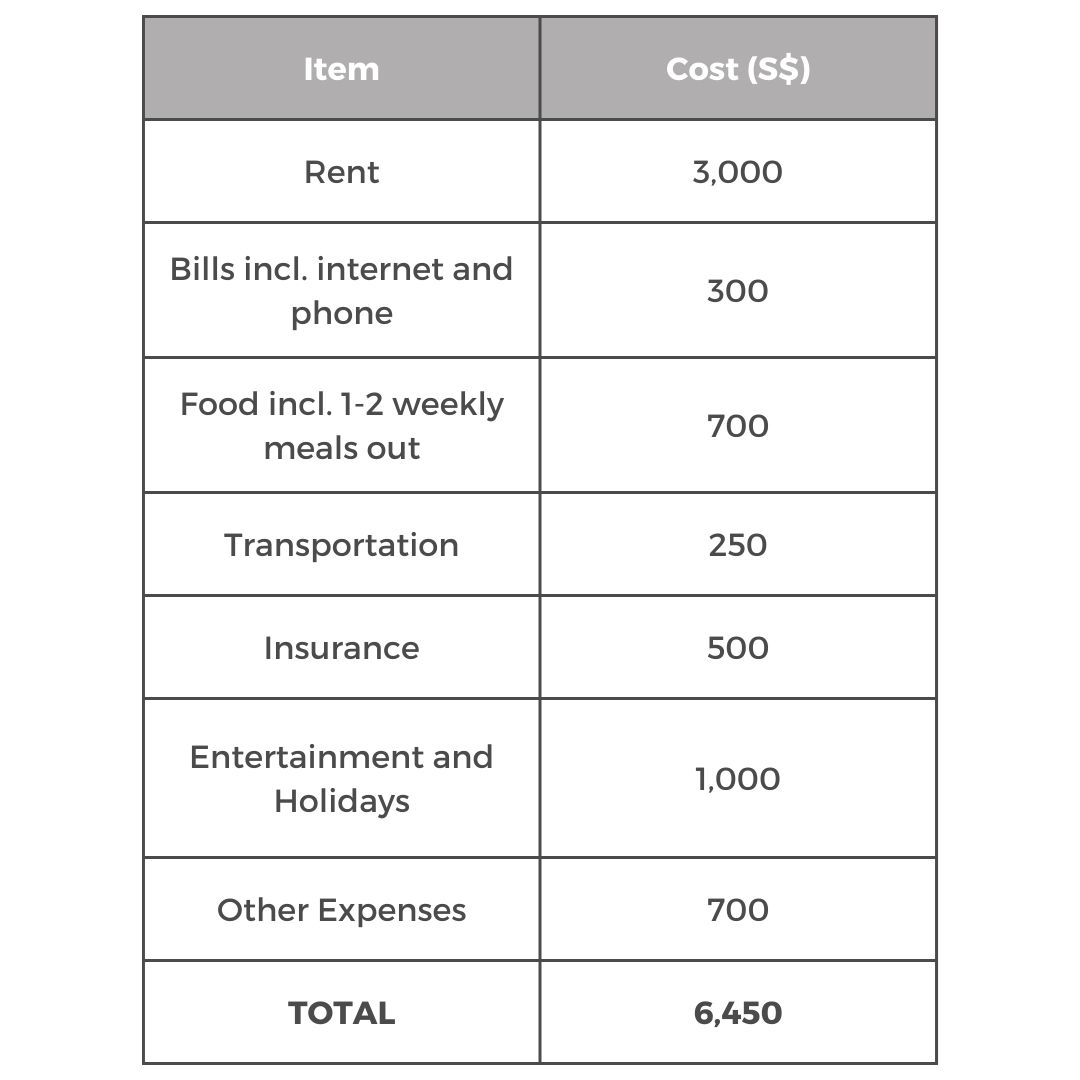

Sample Monthly Budget: Couple Without Children

The cost of life in Singapore for foreigners varies greatly by area, lifestyle, and personal situation. Here’s what a professional couple without children might spend. Our assumptions are:

- They don’t have a car.

- They mostly cook at home but eat out once or twice a week.

- They don’t need additional insurance coverage because they don’t have any dependents.

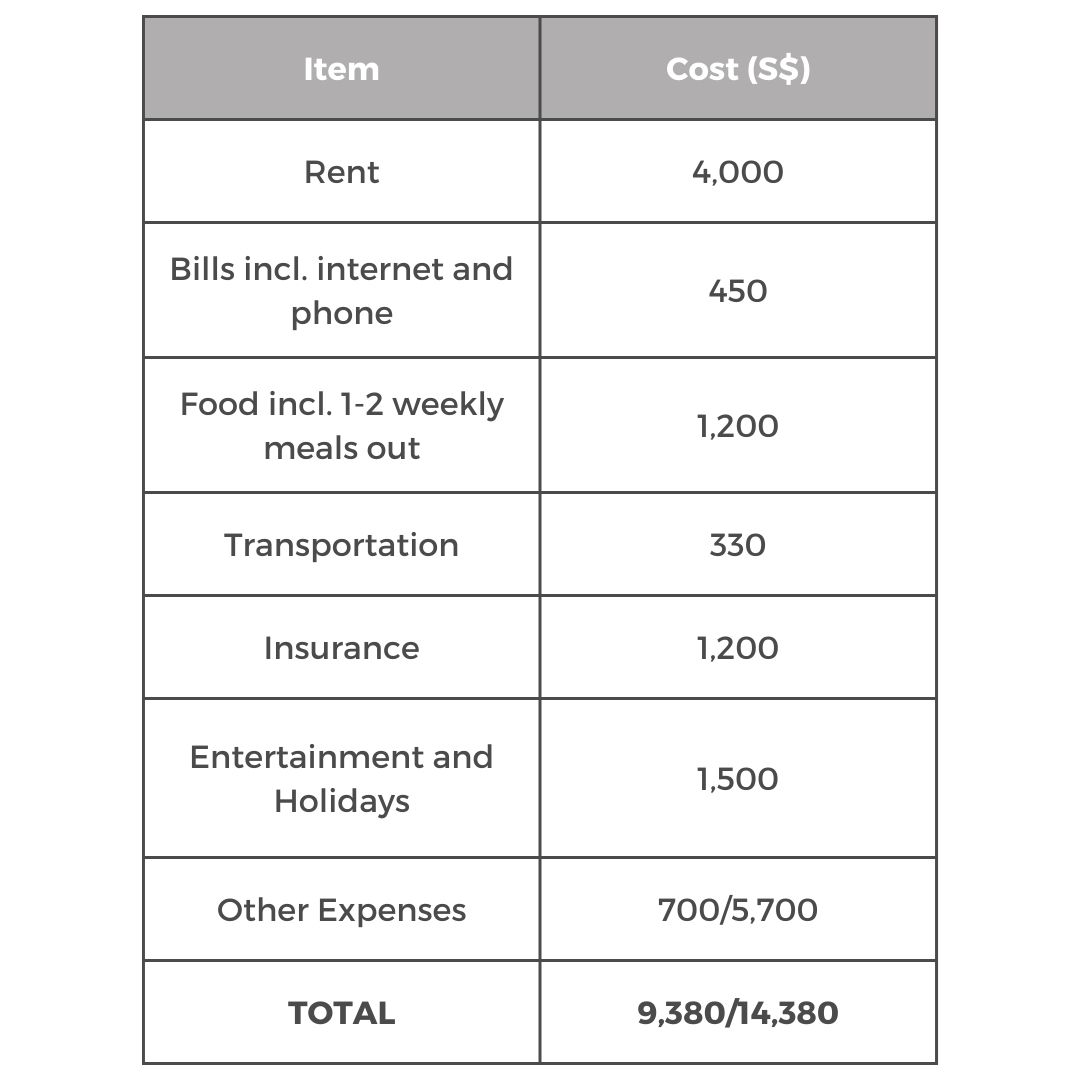

Sample Monthly Budget: Family of Four

Here’s what a family with two children might spend. Our assumptions are:

- They don’t have a car.

- They mostly cook at home but eat out once or twice a week.

- They need life insurance to cover their dependents.

- In the ‘Other’ category, one option excludes private school and the other includes it at S$30,000 per child per year.

The cost of life in Singapore for foreigners depends on the individual’s lifestyle and family size. Although Singapore is considered an expensive country, the high expat salaries often allow for a comfortable lifestyle. If you’re interested in living and working in Singapore, send Rigby AG your spontaneous application now. We’ll notify you about new jobs that fit your profile.