How Much Is a House in Switzerland in US Dollars?

Should you rent or buy a property in Switzerland? There’s no easy answer to this question. Although many locals and expats live in rental properties in Switzerland, others purchase their own homes. Today, we’ll explore the cost of buying a house or apartment in US dollars and British pounds.

Buying a House or Apartment

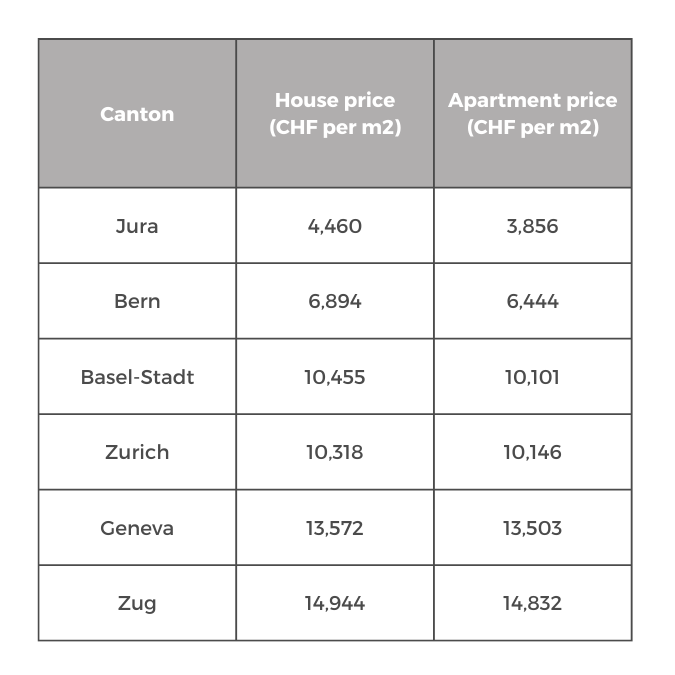

The average house in Switzerland costs 1.19 million Swiss francs, which is currently 1.34 million US dollars and 1.08 million British pounds. However, there are significant regional variations. You can find the cheapest houses and apartments in the canton of Jura. Real estate is the most expensive in the canton of Zug.

In Switzerland, prices are measured per square metre. For reference, one square metre is approximately 10.8 square feet.

Can I Buy a House In Switzerland?

Swiss property can only be bought by locals and people who have authorisation because the government wants to prevent foreign real estate investors from purchasing large proportions of Swiss land. Swiss people and those from an EU/EFTA country who live in Switzerland can purchase real estate without authorisation. However, those from ‘third countries’ who don’t yet have a C permit (permanent residency) need authorisation to buy holiday homes, second homes, and residential units in serviced apartment buildings. They can buy their primary residence without authorisation, as long as they don’t rent it out.

The real estate market can be tough to break into in Switzerland. Most people spend several years renting before they purchase their first home. In Switzerland, many people never buy their own homes, especially those living in popular or affluent areas.

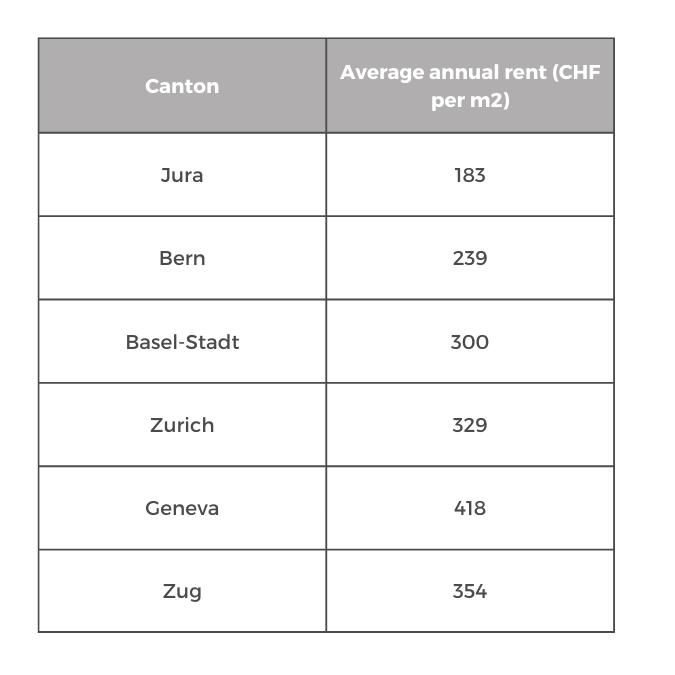

Renting a House or Apartment

Like home prices, rents vary significantly by region. The average house costs 2,700 CHF to rent per month. This is currently 3,038 USD and 2,450 GBP. An average apartment costs CHF 1,595 (1,795 USD and 1,447 GBP) per month. However, smaller apartments are much cheaper. You might only have to pay CHF 950 (1,069 USD and 862 GBP) for a studio flat.

How to Find Good Rental Properties in Switzerland

Finding a rental property can be challenging in popular areas such as central Zurich. If you’re struggling to find a home you like, consider widening your search radius. Because Switzerland is so well-connected, you can easily live in a small town or even a different city and commute to your workplace.

Before you attend viewings, get all your paperwork ready. This includes your residence permit, proof of employment, an excerpt from the debt enforcement register, and sometimes proof of liability insurance. Once you’ve seen a property you like, fill out the application form as soon as possible, ideally within 12 to 24 hours.

Why Are There So Many Renters in Switzerland?

In Switzerland, almost 60% of the population rents. This is very unusual because most other European countries have homeownership rates of at least 65%. While the high real estate prices are partly responsible for the large proportion of renters in Switzerland, they aren’t the only factor.

According to Swissinfo, countries with shakier economies tend to have higher homeownership rates since people feel insecure. This makes them more likely to prioritise buying their own place. In contrast, residents of stable countries like Switzerland don’t need to own real estate to feel safe.

Another factor is the highly regulated rental market in Switzerland. Most rental properties are built to a high standard, and landlords are required by law to take good care of them. Rents can’t be raised without a reason, such as home improvements or interest rate increases. This means that the quality of life is high for most renters.

Should I Buy or Rent?

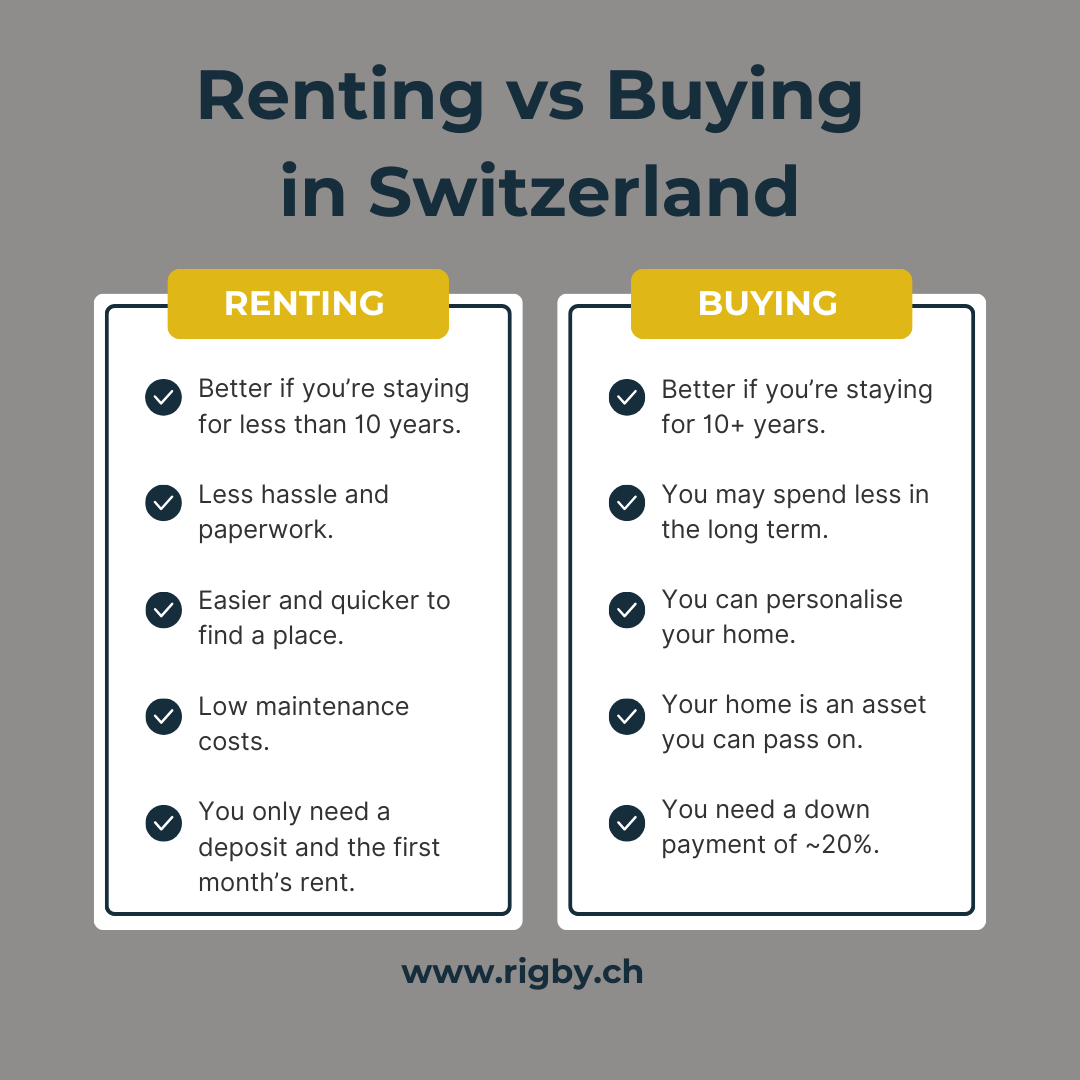

If you’re new to Switzerland, it’s almost always easier to start by renting. Additionally, you might not be eligible to buy a property until you’ve settled in and become a long-term resident.

The Duration of Your Stay

The real estate market can be slow in Switzerland, so it’s best not to purchase a property unless you know you’re going to stay in the same place for at least ten years. It’s also important to note that real estate gains taxes are much lower for long-term than for short-term homeowners. If you sell your property a few years after you buy it, you might pay 30% or more in real estate gains taxes. In contrast, you’ll pay much less, often only 10-15%, if you sell your property after 20 or more years. The exact tax rate depends on the canton, so make sure to research the laws in your desired area.

Your Lifestyle

Renting is convenient in Switzerland. You don’t have to deal with as much paperwork, and you can contact your landlord if there is a problem with your house or apartment. On the other hand, you’re quite restricted in terms of what you can do with your home. Many rental contracts won’t even allow you to paint your walls a different colour, so you can’t personalise your living space as effectively if you rent.

Your Financial Situation

In Switzerland, virtually all lenders require a down payment of around 20%. This means that you need to save up a significant sum before you can buy a property. In the short term, buying is more expensive.

On the other hand, studies have shown that homeowners accumulate significantly more assets throughout their lives than tenants. At age 70, the average homeowner is 11 times wealthier than the average renter. If you’re planning to stay in Switzerland long-term and can afford your own home, buying could help you achieve financial stability in later life.

The average house costs 1.34 million US dollars or 1.08 million British pounds in Switzerland. Although buying a house is a good solution for those who would like to stay for more than five or ten years, most newcomers get rental properties first. Sign up for our newsletter to access our comprehensive Living in Switzerland guide, which provides more in-depth information about finding housing.