A Guide to Insurance in Switzerland

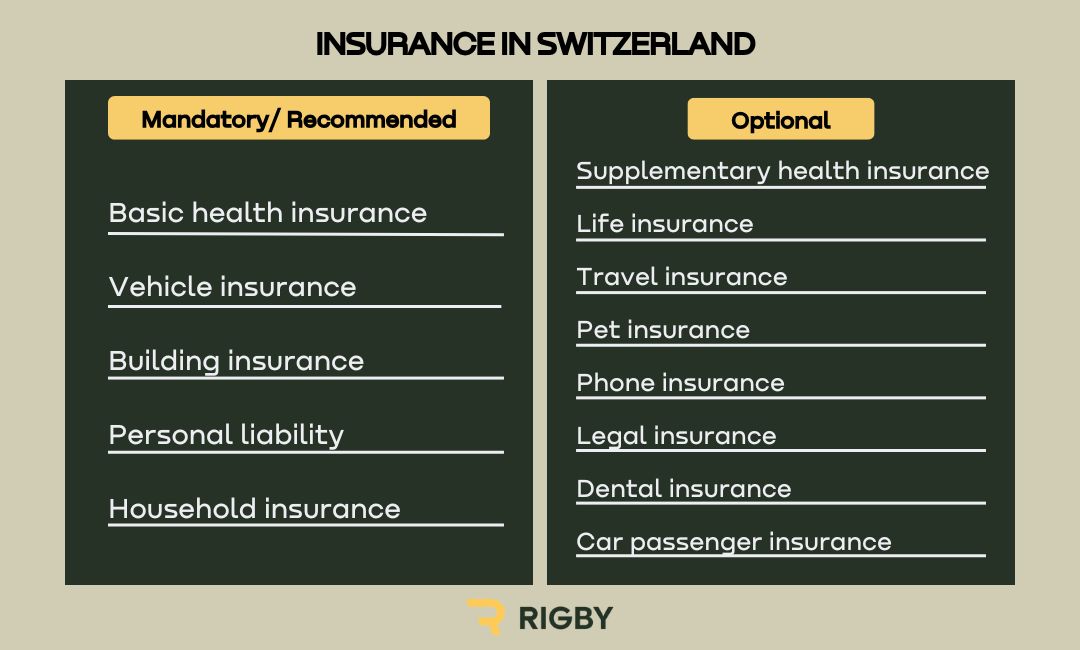

Many people in Switzerland are both overinsured and underinsured. They might lack important insurance policies and at the same time have several policies covering the same risk. Let’s have a closer look at mandatory and optional insurance in Switzerland, so you can save money and avoid exposing yourself to unnecessary risk.

Mandatory Insurance in Switzerland

Contrary to popular belief, most types of insurance are optional in Switzerland. The only universally mandatory policy is basic health insurance, which you need to take out within three months of your arrival in Switzerland. Vehicle insurance is compulsory for anyone who drives their own car or motorbike, and property insurance may be mandatory for homeowners.

Basic Health Insurance

Swiss basic health insurance covers medical treatments as well as hospital stays. It typically costs between CHF 350 and 450 per month for adults over 26 and between CHF 200 and 300 for adults under 26.

There are 50-60 basic health insurance providers in Switzerland. Although they all offer the same coverage, the price difference between them can be great. To get the best deal, use comparison tools like Moneyland and Comparis.

Further reading: Who Pays for Healthcare in Switzerland?

Vehicle Insurance

If you drive a motor vehicle, you have to get third-party liability insurance in Switzerland. For the average car, this might cost between CHF 350 and 500 annually. Factors affecting the cost of basic third-party liability insurance include:

- Your age and experience: Younger or inexperienced drivers typically pay more.

- Your driving history: If you’ve had accidents or significant fines, you might pay more.

- Your gender: Male drivers may pay more.

- Your location: Certain cities like Lugano tend to be more expensive than other cities like Bern.

Property Insurance

Whether property insurance, also called building insurance, is mandatory depends on where you live. Here’s the breakdown:

- Not mandatory: Geneva, Ticino, Valais, and most areas of Appenzell Inner-Rhodes.

- Mandatory, but you can choose a private insurer: Uri, Schwyz, Obwalden.

- Mandatory, and you have to get insurance through the cantonal or base building insurer: All other cantons.

Basic property insurance covers damage caused by most natural disasters, as long as the building is properly maintained. Each canton has different terms and conditions. For example, the price, deductible, and definitions of certain natural disasters might vary.

You can also take out optional supplemental property insurance from a private insurer. This might cover damage that isn’t caused by a natural disaster and damage to additional structures such as sheds and fences, which aren’t typically covered by basic insurance.

Optional Insurance in Switzerland

You can insure almost everything in Switzerland, from the contents of your house to your pet to your mobile phone. However, these policies are optional, and whether or not they make sense for you depends on your situation and risk tolerance.

Supplementary Health Insurance

If you wear glasses, regularly have to go to the hospital, or want to use alternative medicine providers who aren’t accredited in Switzerland, supplementary health insurance might make sense for you. While mandatory insurance is uniform, there are many different supplementary policies that cater to various needs. Some grant you access to private hospital rooms, while others cover the cost of new glasses, alternative medicine, or dental treatment.

Personal Liability Insurance

While personal liability insurance isn’t compulsory in most cantons unless you’re a dog owner, it’s one of the most important types of insurance. It covers you if you inadvertently cause damage to another person, for example by knocking them over with your bike or breaking their property.

The cost of personal liability insurance varies depending on the amount covered and the deductible, but it’s typically low. In many areas, you won’t be able to rent a house or apartment without this policy.

Household Insurance

Household or personal property insurance covers you if something you store at home gets damaged. It usually includes your furniture and personal possessions. If you also need coverage for items like bikes or laptops when they’re not in your home, you can get an insurance rider.

In Switzerland, household insurance is often bundled with personal liability insurance. The premiums are quite low, so many people find this policy useful.

Life Insurance

Life insurance protects your dependents if you pass away unexpectedly. It can be sensible for people who support children or non-working spouses and those who have significant liabilities like mortgages. There are two main types of life insurance:

- Term life insurance covers your family for a specified amount of time, for example until you retire. If you live longer than the term, your insurance expires, and you don’t receive any money back.

- Cash value life insurance, also called whole life insurance, covers your family when you pass away, no matter when this happens.

Most people benefit more from getting term life insurance and saving money in retirement or personal savings accounts. This is because cash value life insurance policies are often expensive, complicated, and untransparent. It is also generally not recommended to get life insurance in your third pillar pension. Instead, a savings or investment third pillar almost always provides better returns.

Travel Insurance

You can get various types of travel insurance in Switzerland. Commonly included elements are trip interruption insurance, trip cancellation insurance, and luggage insurance. If you travel abroad frequently, you might benefit from getting year-round travel insurance. Otherwise, one-off insurance for each trip may make more sense.

Specific Insurance Policies

Other insurance policies are:

- Pet insurance: Partially or fully covers high veterinary costs.

- Mobile phone insurance: Covers some kinds of damage to your phone. Theft isn’t always included.

- Legal insurance: For potential personal and motor vehicle-related legal issues.

- Car passenger insurance: Covers passengers in your vehicle.

- Dental insurance: For treatments that are not covered in your standard or supplemental health insurance policy.

How to Tell What Insurance I Need

Figuring out what insurance in Switzerland you need can be complex because there are so many options. Here’s a step-by-step guide:

Step 1

Determine which insurance policies are mandatory for you. Aside from basic health insurance, you might need home insurance if you own a property and vehicle insurance if you own a car or motorbike. If you’re renting, you may need to get personal liability insurance.

Step 2

Make a list of optional insurance policies that might make sense for you.

Step 3

For each optional policy, ask yourself the following questions:

- How much would the worst-case scenario cost? For example, a new mid-range mobile phone might cost CHF 1,000 or less. On the other hand, you might have to pay hundreds of thousands of francs if you accidentally injure someone and have to pay for their treatment and loss of income.

- Could I afford to pay for the damage in the worst-case scenario? Think about what you would have to do to cover the cost. Is your emergency fund big enough, or would you have to liquidate assets or take out an expensive loan?

- How likely is this scenario? For example, you might be particularly prone to damaging your phone. Although you can afford a new phone, you decide you still need phone insurance because the chances of you damaging your smartphone are very high.

Step 4

Based on your answers, decide whether you need insurance or not. If you’re not sure, consult a professional.

How to Get the Best Deal

Often, multiple insurance providers offer the same type of policy. You can significantly lower your costs by using comparison tools and switching providers when better deals come on the market. Always read the fine print of your policy to determine how often and at what intervals you can switch. Then, make a note of the next available switching time in your calendar, so you don’t forget to check for new offers.

Other tips for reducing your costs include:

Choose Your Deductible Sensibly

Sometimes, you can significantly reduce your premiums by increasing your deductible. This makes sense if you can afford the higher deductible without financial strain.

Choose a Special Insurance Model

Sometimes, special types of insurance are available. For example, there are three health insurance alternatives: the family doctor model, the telehealth model, and the HMO model. All three are more affordable than traditional basic health insurance, but they come with certain restrictions.

Check You’re Not Insured Twice

Most people in Switzerland are already insured against accidents, so taking out car passenger insurance doesn’t usually make sense. Similarly, you may already have travel insurance through a credit card and not need to take out a separate policy. Always make sure you know what kinds of insurance you already have, so you don’t take out the same thing twice.

Many people hold too much insurance in Switzerland. Although the optional policies can be beneficial under certain circumstances, they aren’t always necessary. The best way to stay on top of your insurance costs is to set an annual review date. Download our comprehensive Living in Switzerland ebook now for more information about insurance and other expat-relevant topics.

Disclaimer: This guide is for information purposes only and does not constitute financial advice. We strongly recommend seeking professional assistance for specific enquiries or concerns regarding insurance and other financial matters related to living in Switzerland. The responsibility for any actions taken based on the information in this article lies solely with the reader.